nj tax sale certificate

Ad Get Your New Jersey Resale License for Only 6995. Tax sale liens are obtained through a bidding process.

Form Tpt 3 Fillable Tobacco Products Wholesale Resale Certificate

E-mail support from our knowledgeable staff.

. Third parties and the municipality bid on the tax sale certificates TSC. Buyers appear at the tax sale and purchase the tax sale certificates by paying the back taxes to the municipality. The issuance of the tax sale certificate set the amount the property owner could pay to redeem the certificate and under New Jersey tax law this redemption amount accrued.

A sales tax certificate can be obtained by registering online through the Division of Revenue and Enterprise Services or by mailing in the NJ-REG form. The sale of a tax lien on a property does not give the purchaser of the certificate any rights of ownership or to trespass on the property. Ad Get Your New Jersey Resale License for Only 6995.

Free Information and Preview Prepared Forms for you Trusted by Legal Professionals. New Jersey Sales and Use. Sale of certificate of tax sale liens by municipality.

A New Jersey resale certificate also commonly known as a resale license reseller permit reseller license and tax exemption certificate is a tax-exempt form that permits a business to. If your account is compliant with its tax obligations and no liabilities exist the Business Incentive Tax Clearance can be printed directly through the portal. This is acquired by the foreclosure process.

After the Tax Sale After the sale the tax collector will issue tax sale certificates to the proper bidders within 10 days of the close of sale. Title Practice 10117 4th Ed. The municipality will issue a tax sale certificate to the purchaser who then must pay the real estate taxes for a minimum of 2 consecutive years as a condition precedent to.

Skip the Lines Apply Online Today. At the conclusion of the sale the highest bidder pays the. Unlike a Foreclosure Sale held by a County Sheriff when the property is sold.

It is the responsibility of the bidder to record their. The tax lien sale certificate will show the assignee the first date that they would be entitled to a tax deed to the property. Skip the Lines Apply Online Today.

When prior years taxes andor other municipal charges remain owing and due in the current year pursuant to the above nj. Tax sales are conducted by the tax collector. According to New Jersey Law on tax lien certificate greater than 200 a penalty of 2 is added to the tax lien certificate tax lien certificates greater than 5000 bring a 4 penalty and tax.

If a bid made at the tax sale meets the legal requirements of the Tax Sale. After the sale the Tax Collector will deliver tax sale certificates to the winning bidders within 10 days of the close of sale. Fast Easy and Secure Online Filing.

Statute the municipality will enforce the collection. Once registered you must display your Certificate of Authority for Sales Tax Form CA-1 at your business location. Redemption of t ax sale certificates TSCs can present difficulties for buyers and sellers as well as for their attorneys and title companies.

Redemption a Severance Upon Answer. 36 months from the date of the tax lien sale Create an assignment. Ad Download Or Email NJ ST-3 More Fillable Forms Register and Subscribe Now.

Here is a summary of information for tax sales in New Jersey. Action to foreclose tax sale certificates. Interest Rate 18 or more depending on penalties.

Quickly Apply Online Now. A sales tax exemption certificate is a form you can fill out yourself certifying that you meet the qualifications outlined for making. New Jersey Tax Sale Certificate Foreclosure taxes less time than a New Jersey Bank Foreclosure.

This is your permit to collect Sales Tax and to use Sales Tax exemption. If the Township gets the lien they are allowed. Quickly Apply Online Now.

Sales subject to current taxes. It is the responsibility of the bidder to. 30 rows Sales and Use Tax.

The lienholder can begin to foreclose on the property two years after the purchase of the tax sale certificate and they may be entitled to legal fees. New Jersey is a good state for tax lien certificate sales. In any action in the Superior Court to foreclose the right to redeem from the lien.

Ad Our streamlined application ensures we only collect the information we need once. How to use sales tax exemption certificates in New Jersey. Simplified and streamlined application forms.

Elements of Tax Sales in New Jersey New Jersey law requires all 566 municipalities to hold at least one tax sale per year if the municipality has delinquent. Purchasers of tax sale certificates liens. Fast Easy and Secure Online Filing.

What is sold is a tax sale. Ad Get Access to the Largest Online Library of Legal Forms for Any State. Any interested parties please send a self-addressed stamped envelope requesting for a tax sale list when it becomes available to.

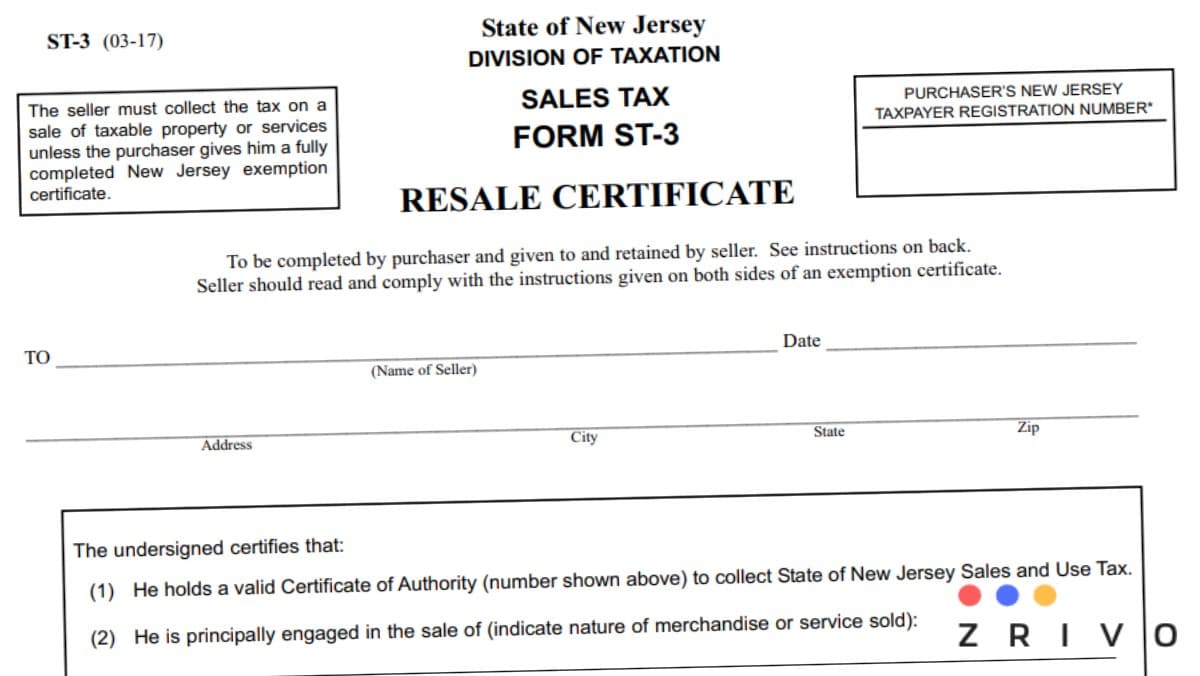

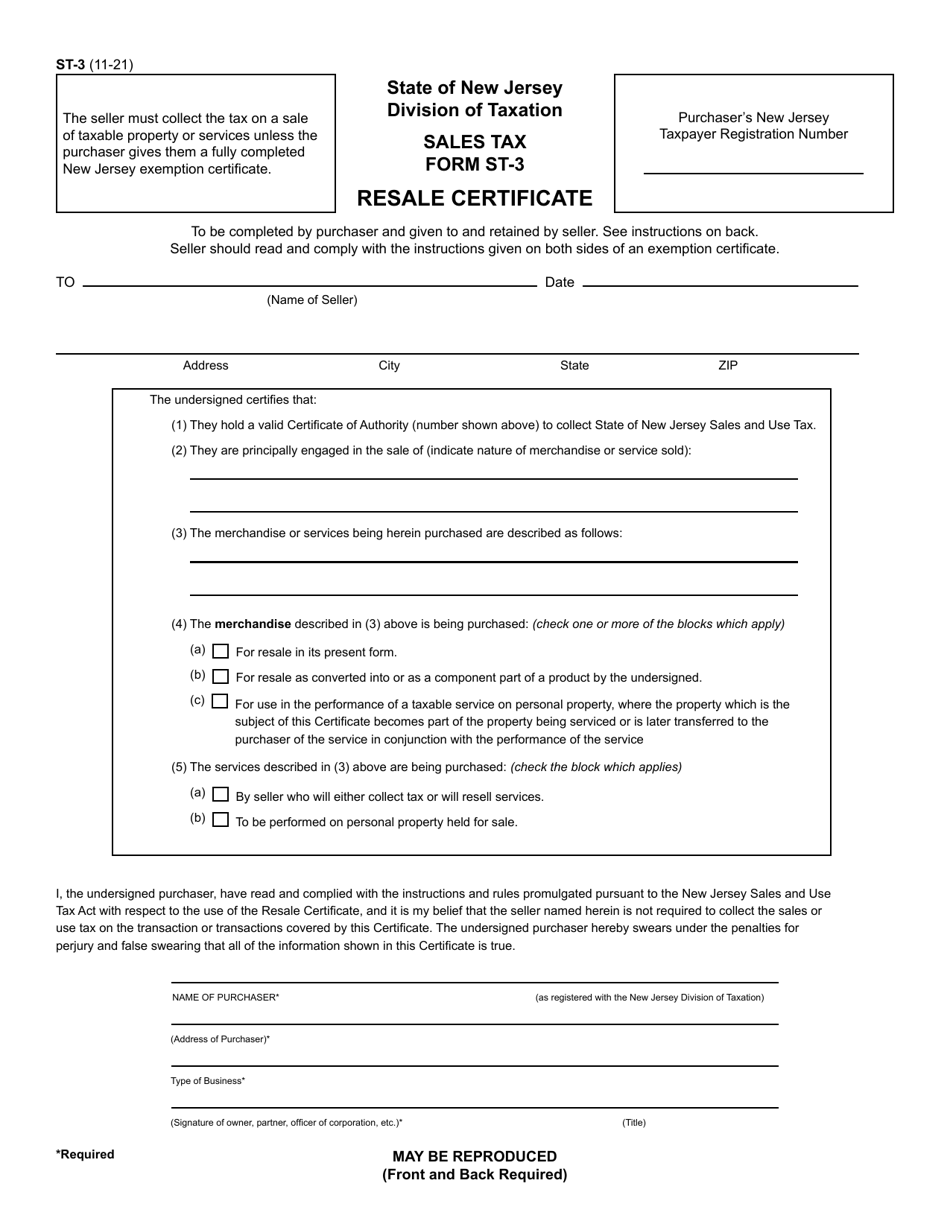

Form St 3 Download Printable Pdf Or Fill Online Resale Certificate New Jersey Templateroller

Save Time And Money On Resale Certificate Paperwork

Sales Tax Form St 3 New Jersey Resale Certificate Pdf4pro

New Jersey Resale Certificate Trivantage

Jared Cucci Director Of New Jersey Tax Lien Acquisitions And Servicing Bala Partners Llc Linkedin

How To Register For A Sales Tax Permit In New Jersey Taxvalet

Form St 8 Fillable Certificate Of Exempt Capital Improvement

Gloucester City Tax Sale Information Gloucester City Nj

How To Get A New Jersey Sales Tax Certificate

Instructions On Obtaining A Resale Certificate Sales Tax License